Financial institutions use data analytics to reduce default risks as early as the advisory process

Due to inflation and very high energy costs, companies and private individuals are currently having to contend with a significant additional financial burden. This also increases the credit risk for banks and savings banks. Nevertheless, financial institutions are required to generate business even in times of crisis. How can advisors address this dilemma already in […]

How data analytics can help banks create value from transactional data.

Data analytics as a success factor in the customer relationship More and more banks are adopting a customer-centric rather than product-centric approach. To ensure that customers receive tailored, individual advice, existing transaction data must be analyzed intelligently using data analytics – for example, to exploit life-changing moments for the customer relationship. But many banks are […]

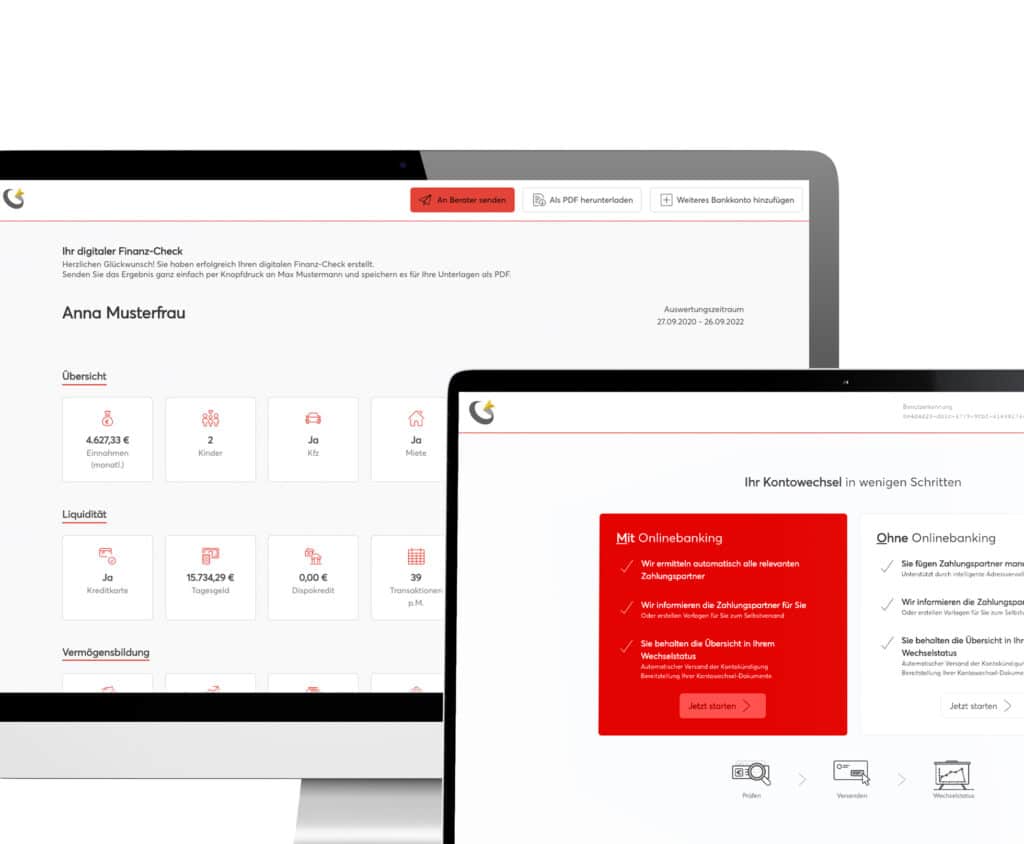

3 Savings Banks rely on digital account switching service

fino‘s account switching service is a great success. More than 3 million customers have already used the service to switch their accounts. Now Sparkassen Mainfranken Würzburg, Kreissparkasse Gelnhausen and Förde Sparkasse are also using the digital account switching service. In a recently published article in Geldinstitute, the trade journal for banks and savings banks, the […]

What are the advantages of using PSD2 License as a Service?

Open banking solutions provider Noda benefits from fino’s PSD2 License as a Service (LAAS). Noda is a well-known provider of Open Banking solutions for online services. The company focuses in particular on direct communication with online merchants, offering them instant access to new technologies that help them grow faster. In an interview, Anastasia Tenca, COO of […]

Change estate account easily and on time

Our account switching assistance recently included a new feature for estate account switching that massively simplifies the processing of estate cases for banks and savings banks. In an interview, our Product Owner “Account Switching Products”, Andreas Burkart, explains the background. Andreas, what is account switching assistance? Basically, this is a software for banks and savings […]

Financial advice of the future: account and data analysis!

Financial advice of the future and how account and data analysis supports financial advisors at B-Group AG in the process. Digitization in financial services continues to make inroads and a growing number of solutions for financial advisors are available on the market. These include, for example, applications for AI-supported account and data analysis, which help […]